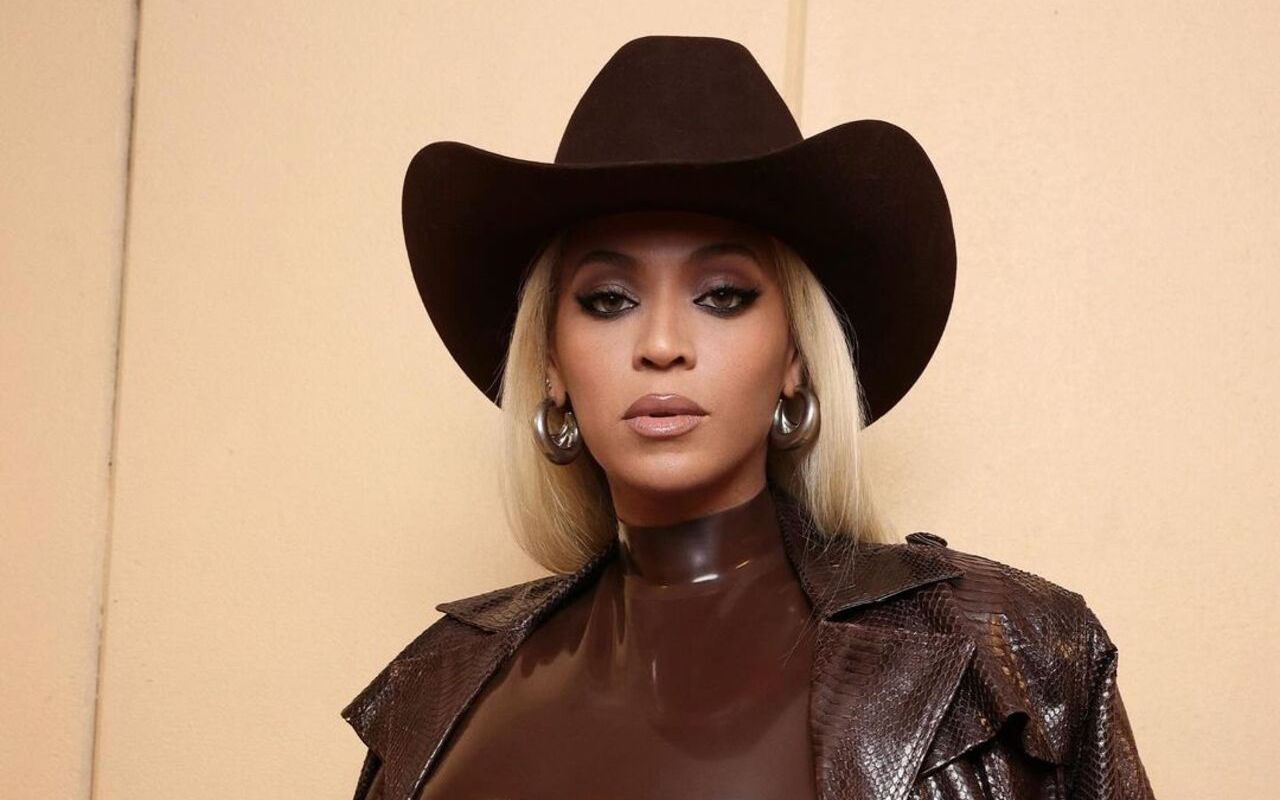

The 42-year-old 'Texas Hold 'Em' hitmaker has filed a response after the Internal Revenue Service accused her of failing to properly pay her taxes on two returns.

- Apr 6, 2024

AceShowbiz - Singer Beyonce Knowles has filed a petition to challenge a tax deficiency of $3 million imposed by the Internal Revenue Service (IRS). The IRS alleged she failed to properly pay taxes on her 2018 and 2019 returns.

For 2018, the IRS claimed she owed an additional $805,000 in taxes and $161,000 in penalties. For 2019, the claimed taxes and penalties were $1.4 million and $288,000, respectively. The debt will accumulate interest until it is paid in full.

In her petition, Beyonce argues that the IRS made an error in disallowing millions of dollars in deductions, including $868,766 related to a charitable contribution carryover reported in 2018.

The trial scheduled for May in the Tax Court to resolve the dispute has been delayed, according to an order issued on Thursday, April 4.

In addition to the tax deficiency, Beyonce has also been affected by a new tax regulation that requires individuals to report any income over $600 received from settlement organizations such as Venmo or Ticketmaster. This change came into effect as part of the American Rescue Plan Act.

Previously, only sellers who earned over $20,000 and made at least 200 transactions annually were required to report earnings. Now, anyone making $600 or more will have to report it to the IRS, regardless of the number of transactions.

The IRS is expecting a significant increase in 1099-K tax forms as a result of this change, with an estimated 44 million forms to be issued for the 2023 tax year. Congress is considering legislation to raise the threshold back to $20,000, but those efforts have not yet progressed.