Celebrity

Movie

Music

Latest News

- 53 minutes ago

Phaedra Parks Shares If She Will Return to 'Real Housewives of Atlanta' Season 16

In a new interview, the former Bravo personality, who left the hit reality TV series in 2017, has sparked speculation about a possible return for its upcoming season 16.

- 1 hour ago

Jon Gosselin on Weight Loss Journey as He Plans to Propose to Girlfriend Stephanie Lebo

Embarking on a personal renaissance, the former reality TV star reveals his significant weight loss journey, his blossoming relationship with Stephanie Lebo and hints at a future proposal.

- 2 hours ago

Taylor Swift Continues to Dominate Australian Charts

The 'All Too Well' hitmaker's album 'The Tortured Poets Department' and single 'Fortnight' reach No. 1 in Australia, extending her record-breaking success on the charts.

- 3 hours ago

Matthew McConaughey and Camila Alves Bring Their 3 Kids to Rare Red Carpet Event

Alongside his model wife Camila Alves, the 'Interstellar' actor turns a new occasion in Austin, Texas into a rare family affair as the couple brings along with his three children.

- 3 hours ago

Salma Hayek Calls Husband Francois-Henri Pinault 'Soulmate' in Sweet Wedding Anniversary Post

The 'Magic Mike's Last Dance' actress gushes over her billionaire husband while celebrating their wedding anniversary after getting married fifteen years ago.

- 3 hours ago

Travis Kelce Laughs Off His Accidental Exposure on Podcast Appearance

In a new episode of Travis and Jason Kelce's 'New Heights', Andrew Santino shares a hilarious story of the Kansas City Chiefs tight end's wardrobe malfunction during an interview 4 years ago.

- 4 hours ago

'The Simpsons' Producer 'Sorry' After Killing Off Longtime Character

In a new interview, co-executive producer Tim Long addresses the death of Larry 'The Barfly' Dalrymple and how fans' reactions show how beloved the series is.

- 4 hours ago

Gigi Hadid and Bradley Cooper's Friends and Family Rooting for Their Future Engagement

The pair's closed ones reportedly want to 'see them get engaged soon' as the model and the actor recently went on a private couples vacation with Taylor Swift and Travis Kelce.

- 4 hours ago

Eminem Deemed 'Psychopath' by 50 Cent in Teaser for New Album 'The Death of Slim Shady'

'The Real Slim Shady' rapper announces that he has a new record, which will be released in summer, in a teaser video that features the 'In Da Club' hitmaker.

- 4 hours ago

Julia Fox Claims She Lost Her Identity While Dating Kanye West

In a new interview published, the 34-year-old 'Uncut Gems' star shares that her brief relationship with the rapper left 'such a sour taste' in her mouth.

- 5 hours ago

Miley Cyrus and Mom Tish Seen Together for First Time Since Family Drama With Noah

The 'Wrecking Ball' singer appears to stand by her mother's side following sister Noah's allegations that their mom stole Dominic Purcell from her youngest child Noah.

- 5 hours ago

Kylie Jenner and Timothee Chalamet 'Still Together,' but Not Expecting Their 1st Child

The 'Keeping Up with the Kardashians' alum is reportedly not having a bun in the oven despite reigniting pregnancy rumors after she was seen in a baggy black sweatshirt and sweatpants at her aunt's funeral.

- 5 hours ago

Taylor Swift Sparks Rumors of New 'Eras Tour' Setlist With 'Tortured Poets Department' Songs

The 'All Too Well' hitmaker leaves her fans, famously known as Swifties, excited after treating them to a video documenting her practicing for her upcoming concerts.

- 5 hours ago

Meghan Markle Dragged Over 'Bruised Lemons' in Jam Package for Kris Jenner

The momager takes to Instagram to share a picture of the gift that includes Meghan's limited-edition jam from her new lifestyle brand, American Riviera Orchard.

- 5 hours ago

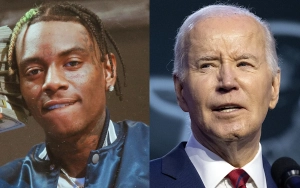

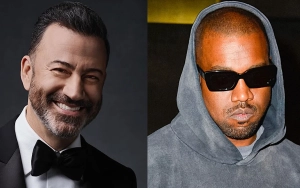

Jimmy Kimmel Trolls Kanye West Over Yeezy's New Venture to Adult Business on 'Live!'

In a new episode of his late-night talk show, the TV personality mocks the rapper after he took to his social media accounts to announce his new controversial project.

- 5 hours ago

Gerry Turner and Theresa Nist 'Tarnish' 'Golden Bachelor' Co-Star's Wedding Officiant Record

Their fellow 'Golden Bachelor' star Susan Noles' perfect streak of officiating marriages that never ended in divorce has come to an end with the split of Gerry Turner and Theresa Nist.

- 6 hours ago

Kelly Ripa and Mark Consuelos See Each Other in New Light Since Co-Hosting 'Live'

Celebrating their first year as co-hosts of 'Live with Kelly and Mark', the couple, who has been married for 28 years, reveals how the show has given them a fresh perspective on each other.

- 6 hours ago

Elisabeth Moss Injured While Filming 'The Veil'

The Emmy-winning actress shows her dedication to the forthcoming spy series by continuing filming with an indomitable spirit despite having fractured her vertebrae during a stunt.

- 6 hours ago

Johnny Depp's 'Jeanne du Barry' Director Slams 'Malicious' Writer After Dissing the 'Scary' Actor

French actress and filmmaker Maiwenn backtracks on her claims that the Hollywood star is 'scary' and can be 'difficult' to work with, saying that she feels 'betrayed' by the interview.